FUNDAMENTAL REVIEW FOR THE WEEK (2 - 6 September 2024)

The week starts with the publication of fairly positive business activity data (PMI from Caixin) in China, which eventually returned to a decrease in interest in risk assets. At the opening of the session, there is also a partial recovery of the single currency against the dollar.

The key event of the week will be the publication of US unemployment data (non-farm) on Friday, which will determine the size of the interest rate cut at the Fed session on September 18. Before that, other important reports will be published, such as the ISM in industry and services on Tuesday, as well as the JOLT reports on Wednesday. These data will be assessed after twenty years of their possible existence in the markets after the publication of the non-farm. For now, the calendar forecast uses strong "payrolls".

If the ISM indices turn out to be weak, pointing to a recession in the US, but the non-farm is significant, the Fed will probably cut the rate by only 0.25%. This can lead to a change in the dollar exchange rate and a decrease in interest in risk assets.

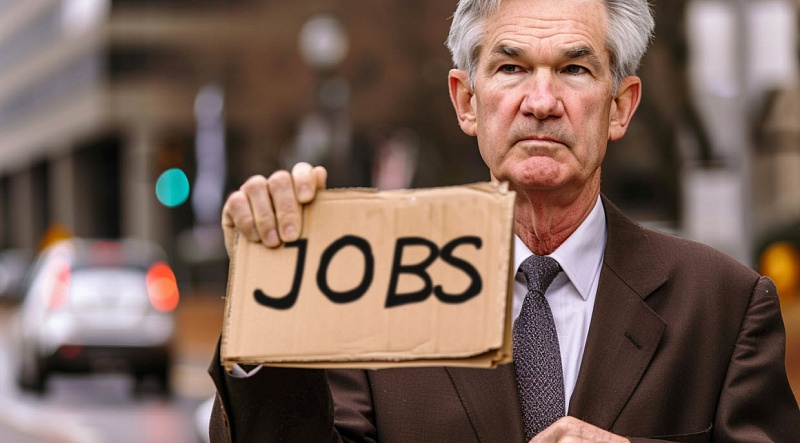

If the ISM is good and the NFP is weak, we can expect risk appetite to increase and the dollar to weaken, as there is no recession yet, and Fed Chairman Jerome Powell has promised to support the labor market.

However, the expectations for such a positive outcome are low, as jobless claims data and an upwardly revised GDP in the second quarter indicate that the economy is stabilizing. Fed members are scheduled to speak on Thursday evening, and they are adjusting market expectations depending on the quality of the NFP data, as this is the last week before the "quiet period" begins before the Fed meeting.

Also worth paying attention to is the Bank of Canada's discussion today, as it follows that after weak GDP data, Canada may cut the rate by 0.50%. As the US and Canadian economies strengthen, such a cut could increase expectations for similar action by the Fed. If the Fed continues to assure the US economy is strong without any action, this could negatively affect sentiment in the economy.

Important moments should not be discounted either - the recent regional elections in Germany, where the Alternative for Germany party won, creating conditions for stability of the euro and the eurozone. However, investors are not yet inclined to take into account the risks associated with the agreements in Germany, which will take place only in a year, since their main focus is on the upcoming elections in the USA and the policies of central banks. But it is definitely worth keeping your finger on the pulse of the political and economic life of the leading EU economies. "Time for change" is coming there.